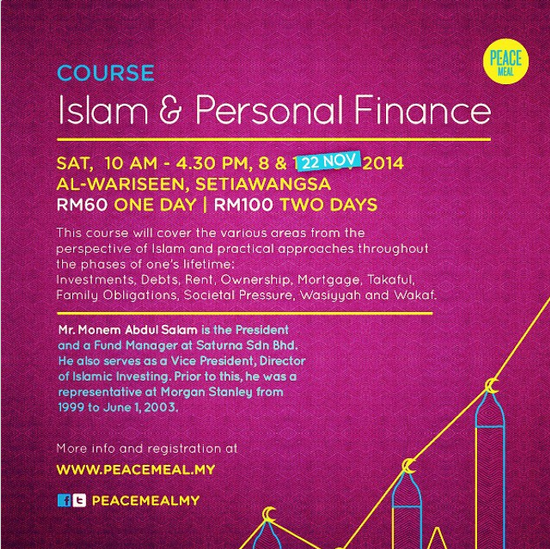

This course will cover the various areas from the perspective of Islam and practical approaches throughout the phases of one’s lifetime: Investments, Debts, Rent, Ownership, Mortgage, Takaful, Family Obligations, Societal Pressure, Wasiyyah and Wakaf. Main Instructor: Monem Salam.

10am – 4.30pm Saturday 8 & 22 November 2014. RM60 for one day, RM100 for two days. Lunch Included. Register below.

Saturday 8 November:

- Introduction to Islamic Finance

- Islamic investing and benefits of compounding. What is Islamic investing? Why is it important to avoid haram in investing? How compounding helps and education planning?

- Debt and it’s evils. As kids get to college, first opportunity to get into debt. What did our Prophet (pbuh) say about it?

- General Q&A session

Saturday 22 November:

- Islamic Mortgages. After college, as staring family, need to buy house? Is it Fardh? What is prudent and what is halal?

- Takaful and family obligations. What happens to you family if you die and they are left with nothing? How do you insure against them being destitute?

- Wasiyyah and wakaf. Everyone should have a will. How much can you leave? Basics of it.

- General Q&A session

*Each session will have its own Q&A portion as well

Mr. Monem Abdul Salam is the President and a Fund Manager at Saturna Sdn Bhd. He also serves as a Vice President, Director of Islamic Investing. Prior to this, he was a representative at Morgan Stanley from 1999 to June 1, 2003. Mr. Salam has also been an Executive Committee Member at ISNA. He has 19 years of experience running Shariah-compliant global investment programs and, over the last few years, private ASEAN investment mandates. Mr. Salam received the “Best Islamic Fund Manager 2005” Award given by Failaka International – via Businessweek.

Recent Comments